The link below will take you to the official guide book on how to figure out square footage in a home. One of our most common legal complaints is the square footage on the MLS and tax records did not match the actual. This is a great reference to have on hand...Enjoy:

American National Standard

Thursday, December 17, 2009

Friday, November 13, 2009

What to do about property taxes?

With lower property values due to our struggling economy, many homeowners have been able to take advantage of an exemption contained in the Michigan Transfer Tax Act. If your seller meets the criteria, they would be exempt from paying the state transfer tax. Following are the criteria:

The property must have been occupied as a principle residence – classified as homestead property.

The property’s SEV for the calendar year in which the transfer is made must be less than or equal to the property’s SEV for the calendar year in which the seller acquired the property.

The property cannot be transferred for consideration exceeding its “true cash value” for the year of the transfer.

For example:

If the SEV of the homestead principle residence when acquired in 2005 is $100,000 and the current SEV on the property is $90,000, then the first two criteria have been met. To establish the “true cash value” of the property, you must double the current SEV at the time of transfer. In this scenario, the true cash value would be $180,000. If the property sold for $170,000, then the 3rd criteria has been met of Exemption “u” as designated by the Michigan Transfer Tax Act.

Please call your local Real Estate One Sales Associate if you have more questions or to chat about this topic.

The property must have been occupied as a principle residence – classified as homestead property.

The property’s SEV for the calendar year in which the transfer is made must be less than or equal to the property’s SEV for the calendar year in which the seller acquired the property.

The property cannot be transferred for consideration exceeding its “true cash value” for the year of the transfer.

For example:

If the SEV of the homestead principle residence when acquired in 2005 is $100,000 and the current SEV on the property is $90,000, then the first two criteria have been met. To establish the “true cash value” of the property, you must double the current SEV at the time of transfer. In this scenario, the true cash value would be $180,000. If the property sold for $170,000, then the 3rd criteria has been met of Exemption “u” as designated by the Michigan Transfer Tax Act.

Please call your local Real Estate One Sales Associate if you have more questions or to chat about this topic.

Friday, November 06, 2009

Selling Your Home in a Michigan Winter

Selling a home can be a daunting task in the current market. Now it is even tricker with the onset of winter. While the location of your home is the most important feature to most buyers, it is the one thing that cannot be changed. There are plenty of other factors that you DO have control over that will enhance your ability to sell.

First of all, curb appeal. When a potential buyer pulls up in front of your home what do they see? Rake up the leaves, take out the remnants of last summer's flowers and trim up the perennials. Even though it is the time of year all the vegitaion tends to fade away, a tidy appearance of what remains will be an inviting view from the street. Accentuate your landscape with the use of creative up-lighting. Also pay attention to your entryway. The front door tends to be the focal point of a home. A welcome appearance to your front door will speak volumes to those entering! Make a great first impression.

The first step inside your home needs to have "wow" factor. A clean and fresh entry is a necessity! Organization and proper clutter reduction throughout the home is at the top of the list of things every home seller must do. Remove personal items including family photos, pet beds and children's items. Decorate in neutral colors using mirrors to enhance the sizes of the rooms. Accessorize tastefully, in this case less is always more. You want a potential buyer to be able to visualize their own items in your home but if they are overwhelmed by your belongings they may not be able to imagine anything at all.

Above all else, be realistic. Price, terms and condition are all factors in the home selling equation. To help you determine what those things are, choose a professional REALTOR to assist you. A true professional will know the facts about your local market and can recommend a sound marketing plan to help get you the results you desire. Homes are selling and with the right tools and attitude, you can achieve success.

First of all, curb appeal. When a potential buyer pulls up in front of your home what do they see? Rake up the leaves, take out the remnants of last summer's flowers and trim up the perennials. Even though it is the time of year all the vegitaion tends to fade away, a tidy appearance of what remains will be an inviting view from the street. Accentuate your landscape with the use of creative up-lighting. Also pay attention to your entryway. The front door tends to be the focal point of a home. A welcome appearance to your front door will speak volumes to those entering! Make a great first impression.

The first step inside your home needs to have "wow" factor. A clean and fresh entry is a necessity! Organization and proper clutter reduction throughout the home is at the top of the list of things every home seller must do. Remove personal items including family photos, pet beds and children's items. Decorate in neutral colors using mirrors to enhance the sizes of the rooms. Accessorize tastefully, in this case less is always more. You want a potential buyer to be able to visualize their own items in your home but if they are overwhelmed by your belongings they may not be able to imagine anything at all.

Above all else, be realistic. Price, terms and condition are all factors in the home selling equation. To help you determine what those things are, choose a professional REALTOR to assist you. A true professional will know the facts about your local market and can recommend a sound marketing plan to help get you the results you desire. Homes are selling and with the right tools and attitude, you can achieve success.

Wednesday, October 14, 2009

September Market Update

The big continuing question is: Are the last four months a real bottom and bounce up or just an illusion? The answer is a little of both. There is no question we are at a bottom, the bigger issue is how long will we stay here and is there a chance of a second "dip" down (i.e., a "W" vs. a "V" recovery). The second dip will be largely dependent on to what degree the government extends or adds to the current housing stimulus efforts. A reduction of the stimulus will cause a downward dip.

If there ever was an example of government dollars and intervention at work, the current housing market is it. There are four key government support elements at play and a fourth private sector effort that contribute to the improving housing numbers we are seeing both in Michigan and across the country.

1) The First Time Home Buyer Tax Credit, creating over 400,000 sales out of a national total of 1.4 million (both NAR and Moody's stats)

2) The government's financial support of Fannie Mae, Freddie Mac and the FHA - Contrary to what the average person may think, these are the chief buyers and creators of mortgage products, not banks. FHA mortgages constitute nearly 70% of all John Adams mortgages.

3) Low interest rates, created by a near zero % federal funds rate and the government's purchase of most of the mortgages being made (since other financial institutions don't want to buy them, without the government purchase, rates would have to rise to entice others to buy).

4) The banks current direction, with both a stick and carrot from the government, of a slower release of foreclosed inventories into the market, helping to stabilize home values.

Keep in mind these improving numbers have not yet moved up enough into the middle to upper range home values. That will not really take hold until employment stabilizes, giving two income families (one of the core engines to move up buyer growth) the confidence to sell and buy and the mass of former owners, now renters, the ability to become home owners again.

In Michigan, the overall market in the next 12 months is most likely to be either the same (extended stimulus) or down (not extended), so regardless of the outcome of the stimulus programs, Sellers still need to price aggressively, focusing as much on current competition as comparable sales. Buyers should be aware that an extended stimulus will benefit them but it will, combined with the banks holding back their inventories, also help dry of the current supply, making the best buys more scarce.

As a company, beginning in June, each month has been successively better for us, extremely hectic, but better. The sales are unprecedented in their complexity and in many cases, anxiety. Collectively, each of us, our clients, mortgage, title and staff feel like we are walking up a sand dune, three steps forward and two back. But we are making great progress and in that effort helping people that have never in the past 70 years needed us more.

Here are our numbers for the month, as usual, better than anyone else. Also two very important bragging points, our Traverse City offices were named the Hottest Real Estate Company buy the TC Record Eagle and John Adams is now the number one FHA lender in purchase mortgages in Southeast Michigan!

If there ever was an example of government dollars and intervention at work, the current housing market is it. There are four key government support elements at play and a fourth private sector effort that contribute to the improving housing numbers we are seeing both in Michigan and across the country.

1) The First Time Home Buyer Tax Credit, creating over 400,000 sales out of a national total of 1.4 million (both NAR and Moody's stats)

2) The government's financial support of Fannie Mae, Freddie Mac and the FHA - Contrary to what the average person may think, these are the chief buyers and creators of mortgage products, not banks. FHA mortgages constitute nearly 70% of all John Adams mortgages.

3) Low interest rates, created by a near zero % federal funds rate and the government's purchase of most of the mortgages being made (since other financial institutions don't want to buy them, without the government purchase, rates would have to rise to entice others to buy).

4) The banks current direction, with both a stick and carrot from the government, of a slower release of foreclosed inventories into the market, helping to stabilize home values.

Keep in mind these improving numbers have not yet moved up enough into the middle to upper range home values. That will not really take hold until employment stabilizes, giving two income families (one of the core engines to move up buyer growth) the confidence to sell and buy and the mass of former owners, now renters, the ability to become home owners again.

In Michigan, the overall market in the next 12 months is most likely to be either the same (extended stimulus) or down (not extended), so regardless of the outcome of the stimulus programs, Sellers still need to price aggressively, focusing as much on current competition as comparable sales. Buyers should be aware that an extended stimulus will benefit them but it will, combined with the banks holding back their inventories, also help dry of the current supply, making the best buys more scarce.

As a company, beginning in June, each month has been successively better for us, extremely hectic, but better. The sales are unprecedented in their complexity and in many cases, anxiety. Collectively, each of us, our clients, mortgage, title and staff feel like we are walking up a sand dune, three steps forward and two back. But we are making great progress and in that effort helping people that have never in the past 70 years needed us more.

Here are our numbers for the month, as usual, better than anyone else. Also two very important bragging points, our Traverse City offices were named the Hottest Real Estate Company buy the TC Record Eagle and John Adams is now the number one FHA lender in purchase mortgages in Southeast Michigan!

Thursday, October 01, 2009

FAQ about Foreclosures and HUD Homes

As the fall sets in and the year comes to a close, the First Time Homebuyer Tax Credit is also winding down. To take advantage of the credit you must get your home under contract within the next few weeks. Many buyers are finding themselves in a position where a foreclosure is the home of choice, even if that was not the original intention. Here are some frequently asked questions and answers about foreclosures that may be helpful in this crunch-time...

Q: What does "REO" mean?

A: Real Estate Owned. It's the term the banks use to identify their foreclosure properties. These properties are also considered distressed properties.

Q: How is a HUD property different from any other foreclosure?

A: HUD homes are FHA-insured loan foreclosures. The government owns them. The properties are classified as "insured" or "uninsured". Those that are insured are in good repair and FHA will insure a new loan for a new buyer for the home. Uninsured properties are typically fixer-uppers, and the buyer will be responsible for his or her own financing. Find out more on their website at www.hud.gov.

Q: What are some general guidelines for your market?

A: Many of the properties that are listed require an earnest money deposit of $1000 and are sold "as is". Many REO properties will sell for cash or with a variety of financing including FHA, VA, and conventional financing. One should remember that many times an REO property will be in a somewhat distressed condition.

Q: How are foreclosure properties identified on the MLS?

A: Certain MLS systems have a selection box on their profile form for bank-owned property and others do not. They are listed just like any other property. The best way to find them is by working with a real estate broker who specializes in this kind of home, or by searching the web. Search available listings through www.ourforeclosurehomes.com.

Q: How will the bank determine the selling price? Will banks accept less?

A: When negotiating with asset managers at a bank for the purchase of a foreclosure, they are considered professional sellers. An asset manager will work hard before a property is ever listed to determine fair market value. They order appraisals and hire a broker to advise them about the property's condition and value. Then, they price them accordingly and may or may not accept less.

Q: Will the banks repair the properties that are distressed?

A: Sometimes. The asset manager in charge of the property will confer with his broker prior to listing it to determine if it is a good candidate for repair or rehab. He will then proceed with a marketing strategy - either "as-is" or "repaired". The as-is properties are priced much lower, and the bank typically does not make repairs for these. They feel any repairs should be the responsibility of the buyer since the property's price is already discounted.

If you have any further question, please contact us and we will gladly assist you.

Q: What does "REO" mean?

A: Real Estate Owned. It's the term the banks use to identify their foreclosure properties. These properties are also considered distressed properties.

Q: How is a HUD property different from any other foreclosure?

A: HUD homes are FHA-insured loan foreclosures. The government owns them. The properties are classified as "insured" or "uninsured". Those that are insured are in good repair and FHA will insure a new loan for a new buyer for the home. Uninsured properties are typically fixer-uppers, and the buyer will be responsible for his or her own financing. Find out more on their website at www.hud.gov.

Q: What are some general guidelines for your market?

A: Many of the properties that are listed require an earnest money deposit of $1000 and are sold "as is". Many REO properties will sell for cash or with a variety of financing including FHA, VA, and conventional financing. One should remember that many times an REO property will be in a somewhat distressed condition.

Q: How are foreclosure properties identified on the MLS?

A: Certain MLS systems have a selection box on their profile form for bank-owned property and others do not. They are listed just like any other property. The best way to find them is by working with a real estate broker who specializes in this kind of home, or by searching the web. Search available listings through www.ourforeclosurehomes.com.

Q: How will the bank determine the selling price? Will banks accept less?

A: When negotiating with asset managers at a bank for the purchase of a foreclosure, they are considered professional sellers. An asset manager will work hard before a property is ever listed to determine fair market value. They order appraisals and hire a broker to advise them about the property's condition and value. Then, they price them accordingly and may or may not accept less.

Q: Will the banks repair the properties that are distressed?

A: Sometimes. The asset manager in charge of the property will confer with his broker prior to listing it to determine if it is a good candidate for repair or rehab. He will then proceed with a marketing strategy - either "as-is" or "repaired". The as-is properties are priced much lower, and the bank typically does not make repairs for these. They feel any repairs should be the responsibility of the buyer since the property's price is already discounted.

If you have any further question, please contact us and we will gladly assist you.

Tuesday, August 25, 2009

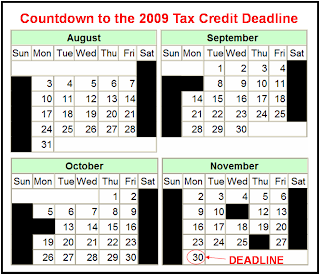

The Time is Now! The 2009 Tax Credit is Winding Down. Don't Miss Out On Your $8,000!

If you are a first time home buyer seeking to take advantage of the possible $8,000 Tax Credit, you may want to get serious. It is officially time to make your move. The closing deadline is November 30, 2009. As of the time of this writing (Aug. 25) you have only 65 business days to close your purchase.

Let's take a look at a practical time line from house hunting to final signatures at the closing table...

Day 1 - 10 - Tour homes and find your dream home then write up an offer.

Day 10 - 17 - Negotiate and get final acceptance signatures.

Day 17 - 30 - Conduct inspections, formally apply for your mortgage, obtain an appraisal and make any necessary repairs.

Day 30 - 40 - Re-inspections and underwriter approvals. Obtain clear to close from all parties.

Day 40 - 45 - Do your final walk-thru and close.

The above is an "ideal" situation with an average time frame. The selling or buying of a home is not always ideal. All too often appraisals take longer than expected, an inspection turns up an unknown issue that must be dealt with prior to closing or funds get delayed the day of closing. Be prepared for these kinds of bumps in the road along the way.

Additionally, there are 4 National Holidays between now and November 30! That's right, we have Labor Day, Columbus Day, Veteran's Day and Thanksgiving to look forward to. You may want to consider this in your personal time frame to be safe. A proactive plan is necessary at this point. Also take into consideration that Wednesday, November 25th could be a 1/2 day for Banks and Title Companies, Thursday is Thanksgiving, Friday is an unofficial holiday making closings unreliable and Monday the 30th is the deadline which makes closing on that day a dangerous gamble. So, if you must wait until November to close - make it early in the month, you'll be glad you did!

Let's take a look at a practical time line from house hunting to final signatures at the closing table...

Day 1 - 10 - Tour homes and find your dream home then write up an offer.

Day 10 - 17 - Negotiate and get final acceptance signatures.

Day 17 - 30 - Conduct inspections, formally apply for your mortgage, obtain an appraisal and make any necessary repairs.

Day 30 - 40 - Re-inspections and underwriter approvals. Obtain clear to close from all parties.

Day 40 - 45 - Do your final walk-thru and close.

The above is an "ideal" situation with an average time frame. The selling or buying of a home is not always ideal. All too often appraisals take longer than expected, an inspection turns up an unknown issue that must be dealt with prior to closing or funds get delayed the day of closing. Be prepared for these kinds of bumps in the road along the way.

Additionally, there are 4 National Holidays between now and November 30! That's right, we have Labor Day, Columbus Day, Veteran's Day and Thanksgiving to look forward to. You may want to consider this in your personal time frame to be safe. A proactive plan is necessary at this point. Also take into consideration that Wednesday, November 25th could be a 1/2 day for Banks and Title Companies, Thursday is Thanksgiving, Friday is an unofficial holiday making closings unreliable and Monday the 30th is the deadline which makes closing on that day a dangerous gamble. So, if you must wait until November to close - make it early in the month, you'll be glad you did!

Monday, August 10, 2009

Pending Home Sales on the Rise Again!

Pending home sales are up for the fifth month in a row, nationally. This information is courtesy of a News Release by the National Association of REALTORS(R) on August 4. This statement is a result of the analysis of pending sales in June 2009 vs. June 2008. During this time period, the number of purchase agreements signed is up by 6.7%. This increase is again attributed to the $8,000 tax credit available to first time home buyers and to the availability of affordable housing.

To read the entire report please click here.

On a more local note, the under $100,000 market is selling strong in the Oakland, Macomb, Livingston, Washtenaw and parts of Wayne Counties (minus the City of Detroit and Gross Pointe areas). The median sales price in these areas (with the exception of Oakland county) continues to plummet, enabling the sell-off of these homes. This sector of the market continues to dominate the closed sales transactions with huge increases over this time last year. These same areas in the over $100,000 market are showing a decrease in the number of closed transactions over last July. Conversely, across the board there is a decrease in the number of homes for sale. The age old theory of supply and demand plays a major part in this market, these trends mark a small step in the direction of recovery.

To view the latest stats please click here.

To read the entire report please click here.

On a more local note, the under $100,000 market is selling strong in the Oakland, Macomb, Livingston, Washtenaw and parts of Wayne Counties (minus the City of Detroit and Gross Pointe areas). The median sales price in these areas (with the exception of Oakland county) continues to plummet, enabling the sell-off of these homes. This sector of the market continues to dominate the closed sales transactions with huge increases over this time last year. These same areas in the over $100,000 market are showing a decrease in the number of closed transactions over last July. Conversely, across the board there is a decrease in the number of homes for sale. The age old theory of supply and demand plays a major part in this market, these trends mark a small step in the direction of recovery.

To view the latest stats please click here.

Monday, July 27, 2009

June Market Recap

The state of Michigan has been weathering the real estate storm for quite some time now. For those of us who are watching it all play out, you may enjoy the positive news coming from the June 2009 statistics. For the under $100,000 market, Livingston County has exploded with activity showing a 176% increase in homes sold over the same period of 2008. The number of available homes is up by 5.3% in that same area for the same time period and price range while the median sale price has slipped by just under 5%. While not all areas have numbers as impressive as this, the tables below illustrate the activity and changes in the surrounding areas. Click the table to enlarge.

Will the rally continue? Will the upper-end price ranges see an increase? Only time will tell. Check back for July numbers in a few weeks…

Will the rally continue? Will the upper-end price ranges see an increase? Only time will tell. Check back for July numbers in a few weeks…

->Data Sources: MiRealSource, Realcomp, Ann Arbor Area Board of REALTORS MLS, Paragon and Broker Metrics.

*Includes Grand Traverse, Kalkaska, Antrim, Leelanau and Benzie Counties, waterfront and vacant land.

Will the rally continue? Will the upper-end price ranges see an increase? Only time will tell. Check back for July numbers in a few weeks…

Will the rally continue? Will the upper-end price ranges see an increase? Only time will tell. Check back for July numbers in a few weeks…->Data Sources: MiRealSource, Realcomp, Ann Arbor Area Board of REALTORS MLS, Paragon and Broker Metrics.

*Includes Grand Traverse, Kalkaska, Antrim, Leelanau and Benzie Counties, waterfront and vacant land.

Monday, July 06, 2009

Good News in Pending Sales; Concerns for Appraisals

For the 4th month in a row, May pending home sales were up. This continued rally is attributed to the combination of the first time home buyer's tax credit and the availability of affordable homes. The Midwest in particular experienced an increase of 11.4% over May 2008. This news is compliments of a Press Release by the National Association of REALTORS published July 1, 2009.

While this is a step in the right direction; there is concern over the number of pending homes that will result in a closing. The new appraisal rules could complicate or prohibit some of these sales from going to closing. As a home seller, it is recommended for you to obtain a current appraisal at the time of listing your home. While this appraisal is for your information only, it will give you a concrete answer to how your home will be evaluated by a professional, unbiased appraiser. As the issue of Short Sales and Foreclosed properties being used for comparison purposes continues to be a problem for traditional sellers, be sure the appraiser used is familiar with your area and uses the best comps available. Choosing an educated and resourceful lender may assist in facilitating a successful sale as well.

Overall, the number of homes for sale continues to be less than in the recent past with the market as a whole continuing to follow buyer's market trends. These along with low interest rates makes now a great time to buy or sell a home.

While this is a step in the right direction; there is concern over the number of pending homes that will result in a closing. The new appraisal rules could complicate or prohibit some of these sales from going to closing. As a home seller, it is recommended for you to obtain a current appraisal at the time of listing your home. While this appraisal is for your information only, it will give you a concrete answer to how your home will be evaluated by a professional, unbiased appraiser. As the issue of Short Sales and Foreclosed properties being used for comparison purposes continues to be a problem for traditional sellers, be sure the appraiser used is familiar with your area and uses the best comps available. Choosing an educated and resourceful lender may assist in facilitating a successful sale as well.

Overall, the number of homes for sale continues to be less than in the recent past with the market as a whole continuing to follow buyer's market trends. These along with low interest rates makes now a great time to buy or sell a home.

Wednesday, June 17, 2009

May Market Update

May continued the same core trends as the prior six months with increasing sales and falling inventories for under $100,000 and the opposite for the above $100,000. There were some signs of the GM and Chrysler effect. The pace of showings and units sales did slow, but the first week of June showed a quick rebound in both again showing the surprising resilience of our market. Our percentage of bank owned and lease sales declined as well in May, reflecting the reduction of bank owned listings in the market. All indications are that it is a temporary shift as banks continue to work through their loan modification efforts to reduce their foreclosures loads. Michigan’s new law allowing homeowners an additional 90 days to negotiate a loan restructure will go into effect August 1st, which will help to reduce and spread out the foreclosure inventory even more.

Great news thanks to the efforts of the Michigan Home Builders Association. HUD has finally issued a Mortgagee Letter that states that condo project approval in no longer required for Site Condos. Also, this month we will be rolling out our Home Mortgage Protection Program that provides mortgage payment protection should a buyer lose their job, similar to what many auto companies are offering. It is offered through John Adams and you will be getting the details next week.

We know that our web site draws the most Michigan traffic, but did you know that our listings are also on 7 of the top 9 national real estate listings web sites (the last two are not yet able to take our listings), covering nearly 40% of all real estate web visitors from those sites alone (Hitwise May reports). We also distribute to 30 (and growing) other sites, focusing on a variety of niches to provide the broadest web exposure of any broker in Michigan.

All lenders and appraisers are under new federal guidelines, making it more difficult to address low or incorrect appraisals. More than ever it is less what the Buyer or Seller think, but what the appraiser thinks for value. In many cases it may be wise for our Sellers to consider appraisals when the home is first put on the market to get an up front feel for any value issues.

For Fence Sitting Buyers who recall high school algebra formulas, this is an important one to keep in mind: Tax Credits + rising interest rates > falling prices. In other words, the value gain receive by taking advantage of both the expiring Tax Credits and low interest rates will exceed any gain from waiting for prices to fall.

Here are our numbers for May as well as the market overview for May and an additional trend analysis for the past 9 months.

Great news thanks to the efforts of the Michigan Home Builders Association. HUD has finally issued a Mortgagee Letter that states that condo project approval in no longer required for Site Condos. Also, this month we will be rolling out our Home Mortgage Protection Program that provides mortgage payment protection should a buyer lose their job, similar to what many auto companies are offering. It is offered through John Adams and you will be getting the details next week.

We know that our web site draws the most Michigan traffic, but did you know that our listings are also on 7 of the top 9 national real estate listings web sites (the last two are not yet able to take our listings), covering nearly 40% of all real estate web visitors from those sites alone (Hitwise May reports). We also distribute to 30 (and growing) other sites, focusing on a variety of niches to provide the broadest web exposure of any broker in Michigan.

All lenders and appraisers are under new federal guidelines, making it more difficult to address low or incorrect appraisals. More than ever it is less what the Buyer or Seller think, but what the appraiser thinks for value. In many cases it may be wise for our Sellers to consider appraisals when the home is first put on the market to get an up front feel for any value issues.

For Fence Sitting Buyers who recall high school algebra formulas, this is an important one to keep in mind: Tax Credits + rising interest rates > falling prices. In other words, the value gain receive by taking advantage of both the expiring Tax Credits and low interest rates will exceed any gain from waiting for prices to fall.

Here are our numbers for May as well as the market overview for May and an additional trend analysis for the past 9 months.

Tuesday, May 19, 2009

April Market Update

April sales continue the same tale of two cities, growing strength in the under $100,000 market and continued slowing in the above $100,000 market, although the rate of decline has begun to decrease in the $100,000 to $250,000 segments. That is good news since recovery in the lower priced markets is the first required stage in a recovery. So far we have seen little effect from the GM and Chrysler news. There could certainly be another negative wave from further auto related changes however I think our market reacted to those changes a year or more ago. The negative impact on the market will be more like a slow leak in a balloon rather than a bursting, not so much dropping our market further as it will extent and slow our recovery.

NAR stats are also showing the beginning signs of a housing recovery across the country with the number of sales rising and housing inventories falling. If your clients are waiting for that perfect time to buy in Florida, Nevada, Arizona, etc, now is the time. More importantly, the same goes for Northwest Michigan as well. Our recovery will be different from the rest of the country, longer and slower, but the national housing recovery will also have a positive effect on Michigan as well.

An important point to keep in mind, more real estate fortunes will be made over the next 5-10 years in Michigan, Florida, Arizona and Nevada than anywhere else in the country!

Our informal survey of the number of vacant homes remains about the same, on average 6-7 out of 10, with more agents indicating that the number is falling as opposed to rising. It still means we are not ready for appreciation to begin, but we are moving in the right direction. You will also notice the large increase in listing inventories for the under $100,000 segments, which is a combination of more bank owned homes in that price range as well as homes that used to be over $100,000 shifting to lower prices.

To generate additional buyer activity, consider dusting off the idea of using Reverse Offers from your Seller back to the Buyer as well as Lease to Own options. Also the new MSHDA down payment assistance combined with the first time buyer tax credit can give a buyer as much as $15,500 towards their home purchase.

NAR stats are also showing the beginning signs of a housing recovery across the country with the number of sales rising and housing inventories falling. If your clients are waiting for that perfect time to buy in Florida, Nevada, Arizona, etc, now is the time. More importantly, the same goes for Northwest Michigan as well. Our recovery will be different from the rest of the country, longer and slower, but the national housing recovery will also have a positive effect on Michigan as well.

An important point to keep in mind, more real estate fortunes will be made over the next 5-10 years in Michigan, Florida, Arizona and Nevada than anywhere else in the country!

Our informal survey of the number of vacant homes remains about the same, on average 6-7 out of 10, with more agents indicating that the number is falling as opposed to rising. It still means we are not ready for appreciation to begin, but we are moving in the right direction. You will also notice the large increase in listing inventories for the under $100,000 segments, which is a combination of more bank owned homes in that price range as well as homes that used to be over $100,000 shifting to lower prices.

To generate additional buyer activity, consider dusting off the idea of using Reverse Offers from your Seller back to the Buyer as well as Lease to Own options. Also the new MSHDA down payment assistance combined with the first time buyer tax credit can give a buyer as much as $15,500 towards their home purchase.

Tuesday, March 24, 2009

NAR's Market Summary - February 2009

EXISTING-HOME SALES RISE IN FEBRUARY WASHINGTON (March 23, 2009) – Existing-home sales increased in February, reversing losses in January. Even so, sales activity remains relatively soft, reflecting additional layoffs and buyers waiting for housing provisions in the economic stimulus package to take effect, according to the National Association of Realtors®. Existing-home sales – including single-family, townhomes, condominiums and co-ops – rose 5.1 percent to a seasonally adjusted annual rate1 of 4.72 million units in February from a pace of 4.49 million units in January, but are 4.6 percent below the 4.95 million-unit level in February 2008. Seasonal adjustment factors are more volatile in winter months, but sales rates over the past few months show dampened sales activity. Lawrence Yun, NAR chief economist, said first-time buyers accounted for half of all home sales last month, with activity concentrated in lower price ranges. “Because entry level buyers are shopping for bargains, distressed sales accounted for 40 to 45 percent of transactions in February,” he said. “Our analysis shows that distressed homes typically are selling for 20 percent less than the normal market price, and this naturally is drawing down the overall median price.” The national median existing-home price2 for all housing types was $165,400 in February, down 15.5 percent from a year ago when the median was $195,800 and conditions were close to normal; the median is where half of the homes sold for more and half sold for less. “Given the downward distortion in price comparisons due to distressed sales, it’s important for owners to keep in mind that this doesn’t equate to a similar loss of value for traditional homes in good condition,” Yun explained. Yun said a recovery in the West is much stronger than expected. “Strong sales gains in the West are led by California, where the median listing price is beginning to rise for the first time in three years,” he said. NAR President Charles McMillan, a broker with Coldwell Banker Residential Brokerage in Dallas-Fort Worth, said home shopping activity has picked up with housing affordability at a record high. “The number of buyers looking for homes rose 5 percent in February, and also was 5 percent above a year ago,” he said. “It appears most of the increase in buyer traffic occurred in the latter part of the month after the $8,000 first-time buyer tax credit was put in place. At the same time, mortgage purchase applications have risen, so we expect to see sales picking up around late spring.” McMillan noted that more potential buyers are learning about the tax credit, just as the traditional spring home-buying season begins. “In this changing market, smart buyers and sellers consult with Realtors® who can advise them about current conditions in their area, and counsel them on the best way to move forward,” he said. According to Freddie Mac, the national average commitment rate for a 30-year, conventional, fixed-rate mortgage edged up to 5.13 percent in February from a record low 5.05 percent in January; the rate was 5.92 percent in February 2008. Last month’s average mortgage rate was the second lowest since data collection began in 1971. Last week the rate further declined to 4.98 percent. Total housing inventory at the end of February rose 5.2 percent to 3.80 million existing homes available for sale, which represents a 9.7-month supply3 at the current sales pace, unchanged from January. In the six months prior to February, the total number of homes for sale had steadily declined from a record level last July. Single-family home sales rose 4.4 percent to a seasonally adjusted annual rate of 4.23 million in February from a level of 4.05 million in January, but are 3.6 percent below the 4.39 million-unit pace in February 2008. The median existing single-family home price was $164,600 in February, down 15.0 percent from a year ago. Existing condominium and co-op sales increased 11.4 percent to a seasonally adjusted annual rate of 490,000 units in February from 440,000 units in January, but are 13.1 percent lower than the 564,000-unit pace a year ago. The median existing condo price4 was $172,200 in February, which is 18.7 percent lower than February 2008. Regionally, existing-home sales in the Northeast jumped 15.6 percent to an annual pace of 740,000 in February, but are 14.9 percent below February 2008. The median price in the Northeast was $251,200, down 4.8 percent from a year ago. Existing-home sales in the Midwest increased 1.0 percent in February to a pace of 1.04 million but are 14.0 percent lower than a year ago. The median price in the Midwest was $131,000, which is 7.8 percent below February 2008. In the South, existing-home sales rose 6.1 percent to an annual pace of 1.74 million in February but are 11.2 percent below February 2008. The median price in the South was $146,700, down 10.0 percent from a year ago. Existing-home sales in the West increased 2.6 percent to an annual rate of 1.20 million in February and remain 30.4 percent higher than a year ago. The median price in the West was $204,600, which is 30.3 percent below February 2008. The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1.2 million members involved in all aspects of the residential and commercial real estate industries.

Wednesday, February 25, 2009

Real Estate Taxes

The Farmington Hills Assessor's office offers a great explanation of real estate taxes and the effects of Proposal A. Click here to view the PDF.

Thursday, February 19, 2009

The market in January was a continuation of the December trend with weather having a significant impact on showings and market activity. The good news is the weather has broken and activity has risen accordingly. The silver lining is the weather did not affect our investor and first time home buyer segments as much, so overall pending sales in the metro area did actual rise, however all of that was in the under $100,000 Investor/First Time price range. All other market segments declined from a combination of weather and economic news.

Offsetting that decline is a continued increase in consumer activity on our web sites, up 18% over January of last year, showing us that there continues to be a pent up buyer demand that is waiting for some good news. The inventory of available homes also continues to decline in all price ranges, which over time will help with stabilizing prices.

The economic stimulus package did not carry the full housing tax credit we had hoped for, but it’s positive impact on housing will still be felt over the next 18 months (building slowly) as the rest of the economy moves. There was some great news for First Time home buyers in the stimulus, the First Time Home Buyer tax credit was raised to $8,000 and does not have to be repaid, so it is a true cash savings on your 2009 tax return! As with any tax credit there are some limitations but simply put, you will receive 10% of your purchase price (max to $8,000) repaid to you from a credit to your federal income tax.

We have a 2008 annual Metro Market Report available by email. If you would like a copy, please email customercare@realestateone.com.

Offsetting that decline is a continued increase in consumer activity on our web sites, up 18% over January of last year, showing us that there continues to be a pent up buyer demand that is waiting for some good news. The inventory of available homes also continues to decline in all price ranges, which over time will help with stabilizing prices.

The economic stimulus package did not carry the full housing tax credit we had hoped for, but it’s positive impact on housing will still be felt over the next 18 months (building slowly) as the rest of the economy moves. There was some great news for First Time home buyers in the stimulus, the First Time Home Buyer tax credit was raised to $8,000 and does not have to be repaid, so it is a true cash savings on your 2009 tax return! As with any tax credit there are some limitations but simply put, you will receive 10% of your purchase price (max to $8,000) repaid to you from a credit to your federal income tax.

We have a 2008 annual Metro Market Report available by email. If you would like a copy, please email customercare@realestateone.com.

December Market Update

Here are the overall market stats for December along with our company numbers for the month and the entire year. Following the market, our units were up nearly 10% (to 14,934) with volume down 18% (to $1,970,938,890) for the year. For Southeast Michigan, December ended like the rest of the year, a continued settling of home values with a significant increase in the number of homes pending. It is rather remarkable that the number of homes sold and leased have continued to grow (2008 over 2007) considering the economic uncertainty that hangs over the State. Granted that increase has come from the under $100,000 home value segment (the segments above $100,000 declined in terms of units in 2008); however those sales do create additional activity. Most are first time buyer and investor sales that have a higher turnover rate as do leases, driving the move-up price range sales as home inventories shrink. Median home values took a significant drop in 2008, falling 38%, most of that is from the shift of buyers to those lower priced homes, as opposed to value declines. The Case/Shiller numbers are a better indicator of true home value changes at around -12%. Northwest Michigan moved in a different direction with the number of homes sales off by 20% while the average home price declined only 6%. As a positive sign, For Sale inventories have begun to decline however it is logical that further price declines can be expected in northern markets as well. Our numbers for the month and for the year are once again the best in the State.

Subscribe to:

Posts (Atom)