Let's take a look at a practical time line from house hunting to final signatures at the closing table...

Day 1 - 10 - Tour homes and find your dream home then write up an offer.

Day 10 - 17 - Negotiate and get final acceptance signatures.

Day 17 - 30 - Conduct inspections, formally apply for your mortgage, obtain an appraisal and make any necessary repairs.

Day 30 - 40 - Re-inspections and underwriter approvals. Obtain clear to close from all parties.

Day 40 - 45 - Do your final walk-thru and close.

The above is an "ideal" situation with an average time frame. The selling or buying of a home is not always ideal. All too often appraisals take longer than expected, an inspection turns up an unknown issue that must be dealt with prior to closing or funds get delayed the day of closing. Be prepared for these kinds of bumps in the road along the way.

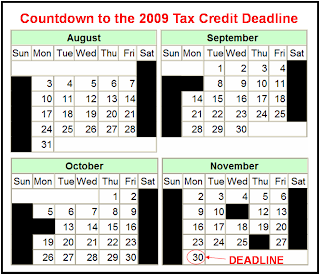

Additionally, there are 4 National Holidays between now and November 30! That's right, we have Labor Day, Columbus Day, Veteran's Day and Thanksgiving to look forward to. You may want to consider this in your personal time frame to be safe. A proactive plan is necessary at this point. Also take into consideration that Wednesday, November 25th could be a 1/2 day for Banks and Title Companies, Thursday is Thanksgiving, Friday is an unofficial holiday making closings unreliable and Monday the 30th is the deadline which makes closing on that day a dangerous gamble. So, if you must wait until November to close - make it early in the month, you'll be glad you did!